Recent Fundings

Canoga Park, CA

$6,050,000

Kevin, as usual, you always get my deals done at what you say you can do and more! ~ Your longtime client, Jeannie Rios., Investor

Indio, CA

$9,197,500

Kevin, as originally advertised by my Real Estate Broker several years ago, you and your all-star team always deliver exactly what you say you will. Your client for life! ~ Daniel Talamentes, Investor

Corona, CA

$2,535,000

I have been working on multiple transactions with Kevin and his entire professional and courteous TEAM at TLC for the past 5 years. I am so grateful that my Real Estate Broker referred me when I was purchasing an apartment building in Orange County, CA back in 2017. Since that first transaction, you and your TEAM have impressed me with your expertise, top notch service, transparent and on-time communication, and your tenacity to always deliver the very best the marketplace has to offer. Thank you again for another great loan experience, and I look forward to many more transactions together in the future. ~ Max Salehi, Investor

Huntington Beach, CA

$11,100,000

I was originally introduced to Kevin Mitchell and his remarkable team by my Real Estate Agent in 2013, when purchasing a 14-unit property in Fullerton CA. Since then, I have worked with Kevin and Team TLC on multiple transactions. As a full-time Real Estate Investor and Property Manager for the past 43 years, I am always busy with managing my business. It is mandatory for me to have a team of professionals that I can trust, navigating the financing for me. The team’s ability to decipher the dynamics of each deal upfront, source the absolute best debt options available in the market, and then deliver five-star results each time is worth its weight in gold. They are meticulous, accessible, and always a pleasure to do business with. I genuinely look forward to the next time we can all work together again. ~ William Bruce, Investor

Corona, CA

$1,503,750

I have been working on multiple transactions with Kevin and his entire professional and courteous TEAM at TLC for the past 5 years. I am so grateful that my Real Estate Broker referred me when I was purchasing an apartment building in Orange County, CA back in 2017. Since that first transaction, you and your TEAM have impressed me with your expertise, top notch service, transparent and on-time communication, and your tenacity to always deliver the very best the marketplace has to offer. Thank you again for another great loan experience, and I look forward to many more transactions together in the future. ~ Max Salehi, Investor

Alabaster, AL

$625,000

Thank you, Kevin, for helping me with my own personal purchase of this Starbucks in Alabama. As usual, you are truly knowledgeable and professional and always deliver personalized service! ~ Veronica Raczkowski, Investor & Realtor

Buena Park, CA

$2,410,000

I’ve been working solely with Kevin and TLC on my investment property financing for close to 20 years, and he and the team have always done an outstanding job. Everyone on the team has always been very professional and helpful. The loan process is always smooth and efficient, and I know that what is promised up front is what I can expect at closing. The results always exceed my expectations. ~ Kevin Relock, Investor

Norwalk, CA

$1,965,000

I was introduced to Kevin and his team at TLC Financial Network by my residential mortgage broker. I needed to refinance two of my industrial buildings in the Los Angeles area right away. So, I am very grateful that I met Kevin and his team when I did. Right from the start, they dove right in, and aggressively shopped my deals through their nationwide network of commercial lenders with proven track records. They delivered me a conventional loan with a remarkably low fixed rate, without having to go with another SBA loan again. I was also able to take out a significant amount of cash, to use for a planned business expansion project. I would highly recommend Kevin and his team to anyone that is looking for true professionalism and the best service, that I have found in the lending business, in the decades I have been a business owner and real estate investor. I will definitely be in touch when I need your services again! ~ John Fintland, Business Owner & Real Estate Investor

South Gate, CA

$920,000

I was introduced to Kevin and his team at TLC Financial Network by my residential mortgage broker. I needed to refinance two of my industrial buildings in the Los Angeles area right away. So, I am very grateful that I met Kevin and his team when I did. Right from the start, they dove right in, and aggressively shopped my deals through their nationwide network of commercial lenders with proven track records. They delivered me a conventional loan with a remarkably low fixed rate, without having to go with another SBA loan again. I was also able to take out a significant amount of cash, to use for a planned business expansion project. I would highly recommend Kevin and his team to anyone that is looking for true professionalism and the best service, that I have found in the lending business, in the decades I have been a business owner and real estate investor. I will definitely be in touch when I need your services again! ~ John Fintland, Business Owner & Real Estate Investor

Long Beach, CA

$811,000

Dear Kevin and the team at TLC, thank you so much for working tirelessly for me on the purchase of this mixed-use property in Long Beach. I know that there were several challenges that didn’t make it easy for you guys. I will be sure to come back and use you guys in the future for all my transactions. ~ Jaipal Dhiman, Business Owner & Real Estate Investor

Riverside, CA

$2,910,000

Kevin, as originally advertised by my Real Estate Broker several years ago, you and your all-star team always deliver exactly what you say you will. Your client for life! ~ Daniel Talamentes, Investor

Whittier, CA

$2,465,000

I've had the pleasure of working with Kevin and his entire team for the bulk of my 24+ year career in apartment brokerage. They continue to exceed my expectations with their efforts, communication, and ability to deliver the results they promise. They're a cut above the competition! Thank you guys! I look forward to continuing a long and prosperous relationship. ~ Rick Applebaum, Investor & Multifamily Advisor with Morgan Skenderian Investment Real Estate Group

Dallas, TX

$1,612,500

As a business owner and investor, I am constantly in need of people I can lean on and trust. I was referred to Kevin, Brian, Noah, Jacob, Austin and their team by a business partner and since then I have utilized their services on four multifamily loans - both in California and Texas. When an investor is in need of a loan, they usually are seeking the best deal with the least amount of strain on their time. I continue to come back to TLC because of their transparent and consistent communication, their ability to source the best rates and terms and their collective focus to make the process as easy on me as possible. I am grateful for their assistance, and they have been instrumental in helping me grow my portfolio. ~ Chase MacLeod, Investor & CEO with MacLeod & Company

Santa Ana, CA

$851,000

Just Funded! This transaction closed in under 45 days from application to funding with clients who were experienced in the STR space but had yet to make the leap to a commercial income property investment. We worked closely with all parties to ensure a smooth closing. We are pleased to report that all goals were met, and loan terms were delivered exactly as promised. The clients were thrilled with the outcome!

Thanks for the great work, guys! You guys were very professional and great to work with! ~ Amrit Sareen, Investor

Huntington Beach, CA

$1,398,000

Just Funded! Our repeat client was in a 1031 exchange and needed to purchase multiple properties to effectuate his exchange which was expiring in about 60 days. He chose this SFR in Huntington Beach, CA, but when he spoke to his residential agency finance connections, all he was hearing was, “The rates are in the high-6’s.” We presented this bank portfolio program in the mid-5’s with no prepayment penalty and no points. We funded the loan in 30 days including the holidays to successfully complete the borrower’s exchange. Rate, loan amount, and terms were delivered exactly as promised! This program can accommodate both long-term leases and short-term rentals.

La Habra, CA

$840,000

Just Funded! We are pleased to announce another successful funding in the heart of La Habra for a new client of ours. We navigated the process with the client (who had limited income property experience) and helped make him comfortable purchasing his first multifamily property which came along with foundation issues requiring construction post-close. Our relationship with the lender allowed us to push the deal through at the same loan amount, rate, and terms as originally promised, while overcoming the challenges that the foundation issues presented. The client was very happy with the outcome!

Thank you for your help, team TLC! I appreciate all your hard work and helping us get to the finish line. Looking forward to working together again in the near future. ~ Dr. Greg Kame, Investor

Garden Grove, CA

$1,521,000

Just Funded! Closed in 17 days! Our new client was referred to us by one of our longstanding Real Estate Broker’s in our Network. The client has acquired a quality 8 unit apartment building in a high demand market in Garden Grove and selected our bridge financing option. The client’s business plan is to notify each tenant under AB 1482’s just cause eviction law(s) and will renovate the entire property to achieve the high side of market rents. We shopped the deal with our vast network of aggressive private capital lenders and were able to carve out a 75% CLTV bridge loan, with funds available for construction, at a “hard to find” single digit interest rate, fixed for 12 months with interest only payments. We also negotiated a 12 month extension available at WSJ Prime + 1.240% if needed. All with no prepayment penalty! Our new client couldn’t have been happier with the financing results we delivered!

Long Beach, CA

$2,650,000

Just Funded! Our longtime client recently decided to hold this asset longer than he originally had planned at the time of acquisition. We immediately went to work on our refinance analysis on a rush. The analysis clearly revealed it was a no brainer to hedge against higher rates in the future, as he was adjusting to an ARM at a significantly higher rate already. With our swift action and our client’s willingness to move quickly, we were able to lock in a sub 6.000% rate (5.950%) for another 5 years with unbeatable terms. Generally, rates on 5 year money are currently higher than that at this time.

I have had the sincere pleasure of working on several transactions with Kevin and TEAM TLC for the past several years. As a Real Estate Investor and Property Manager, I am always very busy with my day-to-day tasks in my business, so it is a must to have a team of professionals in your corner like TLC. Their ability to take my information upfront, quote me the best financing package available in the market, and then consistently deliver what you quote every time is priceless. I am so thankful that we met when we did. I have been a Real Estate Investor and Property Manager for nearly 20 years now, and I have never worked with a group that is so thorough, responsive and such a pleasure to work with. I look forward to the next time we can work together. ~ Morteza Hajian, Investor

Los Angeles, CA

$4,578,000

Just Funded! Closed in 44 days! Our longtime client contacted us about a rare opportunity for him to acquire an irreplaceable asset, at a below market price in Los Angeles just steps away from Hollywood Boulevard. The challenge was, to win the deal, we needed to be able to act fast for him, with the “Mansion Tax” looming over the seller’s head. We immediately went to work for him over a weekend, using our go to funding source and locked in an irreplaceable rate and terms before rates shot up significantly that next week. Our longtime client couldn’t have been more ecstatic with the financing results we delivered!

I have been working on multiple transactions with Kevin and his entire professional and courteous TEAM at TLC for the past 5 years. I am so grateful that my Real Estate Broker referred me when I was purchasing an apartment building in Orange County, CA back in 2017. Since that first transaction, you and your TEAM have impressed me with your expertise, top notch service, transparent and on-time communication, and your tenacity to always deliver the very best the marketplace has to offer. Thank you again for another great loan experience, and I look forward to many more transactions together in the future. ~ Max Salehi, Investor

Anaheim, CA

$540,000

Just Funded! This was a bridge to permanent loan transaction. Located within minutes of Disneyland, our repeat clients, who are highly experienced in the STR space, recently fully renovated this property and we were tasked to advance to the permanent loan phase for them. Although market conditions continue to be onerous, especially in this asset class, we worked tirelessly with all parties to ensure an eminent closing for them. We are pleased to report that all goals were met, and loan terms were delivered exactly as promised. Exactly why we say, “Who Your Navigator Is Matters!” In the end, our clients were thrilled with the outcome!

"Thanks for the great work, guys! As always, you guys were very professional and great to work with!" ~ Amrit Sareen, Investor & Managing Partner

Laguna Beach, CA

$1,500,000

Just Funded! Closed in 21 days! Our new client was referred to us by one of our longstanding Real Estate Broker’s in our Network. The out-of-state client was in a serious jam with nearly no time left on her 1031 exchange deadline. We collectively as a TEAM, put our heads together on how to solve this dilemma for the client. Our Broker acted quickly and was able to get her under contract on a beautiful fully renovated 4 unit apartment building just 5 houses from the sand in Laguna Beach. We quickly closed on our favorite bridge financing option at a “hard to find” single digit interest rate, fixed for 6 months with interest only payments, and no prepayment penalty. This maneuver saved her thousands of dollars in capital gain taxes! We are currently working on obtaining permanent financing and will be paying off the bridge loan here soon. It’s a win win all the way around! Our new client couldn’t have been happier with the financing and tax savings results we delivered!

Pasadena, CA

$1,116,500

Just Funded! Our repeat client recently completed his 1031 exchange with the purchase of this 5 unit apartment building in a highly desirable neighborhood of Pasadena on a large lot with bridge financing. The business plan is to remodel each unit to achieve market rents and build additional units above the carport in under 2 years to capitalize on the large lot. We shopped the deal with our robust network of aggressive private capital lenders and were able to carve out a 70% LTV bridge loan with construction financing on a second TD, with a favorable interest rate fixed for 24 months and with excellent terms. Our client couldn’t have been happier with the financing results!

Dear Kevin, and the entire TLC Team. Thank you for all your patience you have shown me, while assisting me with finding a suitable replacement property for my 1031 exchange. You have introduced me to an entirely new world, with the bridge loan you secured for my new investment. Without your ongoing help, support, and expertise, I wouldn’t have been able to meet my 1031 exchange deadline and requirements. I look forward to having you secure a permanent loan as soon as I am finished repositioning the property. I hope we can do more transactions together here soon and be on the lookout for referrals to my family and friends. ~ Bryan Kwan, Investor

Long Beach, CA

$920,000

Just Funded! We recently contacted our longtime VIP client, on a refinance campaign we ran, alerting our clients to the potential for notable increases in their rates and payments when their loan goes from fixed to adjustable. He expressed serious interest regarding several of his loans, so we swiftly went to work on our analysis for each loan and property. Because we knew from monitoring his loans, we previously funded, he was adjusting to an ARM at a significantly higher rate. Our analysis confirmed it was advantageous to be proactive and stop higher rates from killing his cash flow upon adjustment now and in the near future. With our loan monitoring program, and the ability for our client to recognize the benefits, we were able to lock in a rate at 5.650% for another 5 years with unmatched terms. At the time of funding, even the best rates were clearly .500% greater in the market.

I have had the pleasure of working on numerous transactions with Kevin and his team at TLC for several years now. They are tenacious about extracting the pertinent and necessary information upfront and focusing on quoting me the best financing package available in the marketplace. Because of their years of experience, knowledge, and relationships with key lenders, they always consistently deliver what they propose. I am always busy managing multiple tasks in my business, so it is super valuable to have a team like TLC in your corner that you can trust and who has your best interest at heart. I have been in the real estate and property management industry for over 35 years. It is extremely seldom that you find a team that is so responsive, meticulous, and a pleasure to work with all the way around. I hope we can work together again soon. ~ Eduardo P., Investor & Property Manager

Wilmington, CA

$850,000

Just Funded! We recently contacted our longtime VIP client, on a refinance campaign we ran, alerting our clients to the potential for notable increases in their rates and payments when their loan goes from fixed to adjustable. He expressed serious interest regarding several of his loans, so we swiftly went to work on our analysis for each loan and property. Because we knew from monitoring his loans, we previously funded, he was adjusting to an ARM at a significantly higher rate. Our analysis confirmed it was advantageous to be proactive and stop higher rates from killing his cash flow upon adjustment now and in the near future. With our loan monitoring program, and the ability for our client to recognize the benefits, we were able to lock in a rate at 5.650% for another 5 years with unmatched terms. At the time of funding, even the best rates were clearly .500% greater in the market.

I have had the pleasure of working on numerous transactions with Kevin and his team at TLC for several years now. They are tenacious about extracting the pertinent and necessary information upfront and focusing on quoting me the best financing package available in the marketplace. Because of their years of experience, knowledge, and relationships with key lenders, they always consistently deliver what they propose. I am always busy managing multiple tasks in my business, so it is super valuable to have a team like TLC in your corner that you can trust and who has your best interest at heart. I have been in the real estate and property management industry for over 35 years. It is extremely seldom that you find a team that is so responsive, meticulous, and a pleasure to work with all the way around. I hope we can work together again soon. ~ Eduardo P., Investor & Property Manager

Long Beach, CA

$2,220,000

Just Funded! We recently contacted our longtime VIP client, on a refinance campaign we ran, alerting our clients to the potential for notable increases in their rates and payments when their loan goes from fixed to adjustable. He expressed serious interest regarding several of his loans, so we swiftly went to work on our analysis for each loan and property. Because we knew from monitoring his loans, we previously funded, he was adjusting to an ARM at a significantly higher rate. Our analysis confirmed it was advantageous to be proactive and stop higher rates from killing his cash flow upon adjustment now and in the near future. With our loan monitoring program, and the ability for our client to recognize the benefits, we were able to lock in a rate at 5.650% for another 5 years with unmatched terms. At the time of funding, even the best rates were clearly .500% greater in the market.

I have had the pleasure of working on numerous transactions with Kevin and his team at TLC for several years now. They are tenacious about extracting the pertinent and necessary information upfront and focusing on quoting me the best financing package available in the marketplace. Because of their years of experience, knowledge, and relationships with key lenders, they always consistently deliver what they propose. I am always busy managing multiple tasks in my business, so it is super valuable to have a team like TLC in your corner that you can trust and who has your best interest at heart. I have been in the real estate and property management industry for over 35 years. It is extremely seldom that you find a team that is so responsive, meticulous, and a pleasure to work with all the way around. I hope we can work together again soon. ~ Eduardo P., Investor & Property Manager

Long Beach, CA

$775,000

Just Funded! We recently contacted our longtime VIP client, on a refinance campaign we ran, alerting our clients to the potential for notable increases in their rates and payments when their loan goes from fixed to adjustable. He expressed serious interest, so we swiftly went to work on our analysis. Because we knew from monitoring his loan, we previously funded, he was adjusting to an ARM at a significantly higher rate. Our analysis confirmed it was advantageous to be proactive and stop higher rates from killing his cash flow upon adjustment now and in the near future. Once we engaged in the loan process, we were made aware of our client’s recent retirement. He no longer had the discretionary income when we originated the loan previously. We quickly put our creative caps on, and used our years of experience, expertise, and well-established relationships to carve out something that rarely happens in the commercial lending business. We were able to take his liquid assets he set aside for retirement, and present what is referred to as an “asset amortization”; which showed the credit officer he could meet the required GCF (Global Cash Flow) guideline, by withdrawing monthly payments as needed to service his debts. With our loan monitoring program, and the ability for our client to recognize the benefits, we were able to lock in a rate at 5.850% for another 5 years with unmatched terms. At the time of funding, even the best rates were north of 6% and are now traveling higher at the time of this posting.

My agent introduced me to Kevin at TLC when I was purchasing this six-unit property in Long Beach. Ever since closing, Kevin and his team have always been available for me, when I had questions or needed help with the annual loan reporting requirements. They were proactive with staying in contact with me and alerted me to a significant potential increase in interest rates before it became widely known in the media. Thank you very much for working with me on obtaining this new loan. My wife and I really appreciate your attention to detail and the support you have given us along the way. TLC is a first-class outfit with professional and personable folks. I would highly recommend them to anyone looking for the same experience. ~ Russ Lieu, Investor

Costa Mesa, CA

$1,396,800

Just Funded! Closed in 45 days! Our new client was referred to us by one of our longstanding Real Estate Broker’s in our Network. This well-seasoned full-time Real Estate Investor, who typically only has financed 5+ unit multifamily properties, was enlightened to the qualifying challenges of 1–4-unit residential financing versus commercial financing. Therefore, we went with our “Go To” bank that offers a killer portfolio product that affords much greater flexibility than the traditional agency products; at much better rates and terms to boot!

I am so glad that my agent was able to refer me to your group! I could not have managed this encumber some residential lending process without you folks! The entire TLC team was so patient with me and my wife and a pleasure to work with. ~ Jerry Doidge, Real Estate Investor

Upland, CA

$3,213,132

Just Closed! Our VIP clients recently contacted us with disturbing news. Unfortunately, there was a death in the family by the sole guarantor on a loan we did for them in 2020. Like most people would do, they contacted the Lender to disclose the passing and the fact their family attorney already completed and recorded the Affidavit-Death of Trustee and transferred ownership to the beneficiary(s). As most of us know, in commercial lending, there are stricter rules regarding ownership transfers than in residential lending. Of course, every lender has different legality temperaments based on their written covenants, but unfortunately this lender is extremely strict and immediately filed an NOD (Notice of Default). We have had a longstanding relationship with this lender for well over a decade, and we immediately intervened and were able to get them to press pause on the default process. We were able to negotiate a one-time assumption as afforded for in the loan documents. We processed the beneficiary as the new qualified guarantor and successfully closed the transaction for our VIP clients. Crisis averted! “Real business gets done by forging strong and lasting relationships, everything else is just chaos” ~ Kevin W. Mitchell

Our Real Estate Broker referred us to Kevin and his team, when purchasing a multi-family property in San Gabriel, California a few years ago. Since then, the TLC team has collaborated with us on multiple transactions. The team’s ability to navigate each transaction with accuracy and professionalism is unmatched from our previous experience with other lenders over the years. Their diligence and the way they do business is very uncommon but sure is refreshing. They always go the extra mile and truly make us feel like VIP clients. We are so happy we met when we did and look forward to many more transactions together in the future. ~ The Kwong & Luan Family, Real Estate Investors

Whittier, CA

$330,000

Just Funded! Closed in 27 days! We could have closed sooner but it wasn’t necessary. Our longtime VIP client recently decided to hold this asset longer than he originally had planned at the time of acquisition but was seeking to tap the increased equity appreciation now. We immediately went to work on our analysis, and it clearly revealed it was a no brainer to not touch his low 3.875% 1st mortgage. We scoured our Network and the broader market for a 2nd mortgage that would allow us to tap the equity, to use for another acquisition. We were able to negotiate a 24-month fixed rate at 11.500% with interest only payments, and NO appraisal required! Private Capital product with NO Bank Hassles!

Kevin, as originally advertised by my Real Estate Broker several years ago, you and your all-star team always deliver exactly what you say you will. Your client for life! ~ Daniel Talamentes, Investor

Torrance, CA

$2,715,000

Just Funded! Closed in 42 days! We could have closed sooner but it wasn’t necessary. Our longtime VIP clients fell into a considerably under rented 13-unit apartment building positioned in the coveted Torrance submarket, that was just “too good to pass up.” We were engaged right away and needed to move quickly to secure financing before removing all their contingencies. We shopped the deal with our vast network of aggressive private capital lenders and were able to negotiate a 24-month fixed rate at 10.500% with interest only payments, NO prepayment penalty and NO appraisal required, with a boutique style Private Capital product with NO Bank Hassles! The client’s business plan is to notify each tenant under AB 1482’s just cause eviction law(s) and will renovate the entire property to achieve the high side of market rents. Our VIP clients couldn’t have been happier with the financing results we delivered!

Kevin, as originally advertised by our Real Estate Broker several years ago, you and your all-star team always deliver exactly what you say you will. Your clients for life! ~ Daniel Talamentes & Brad Ammann, Investors

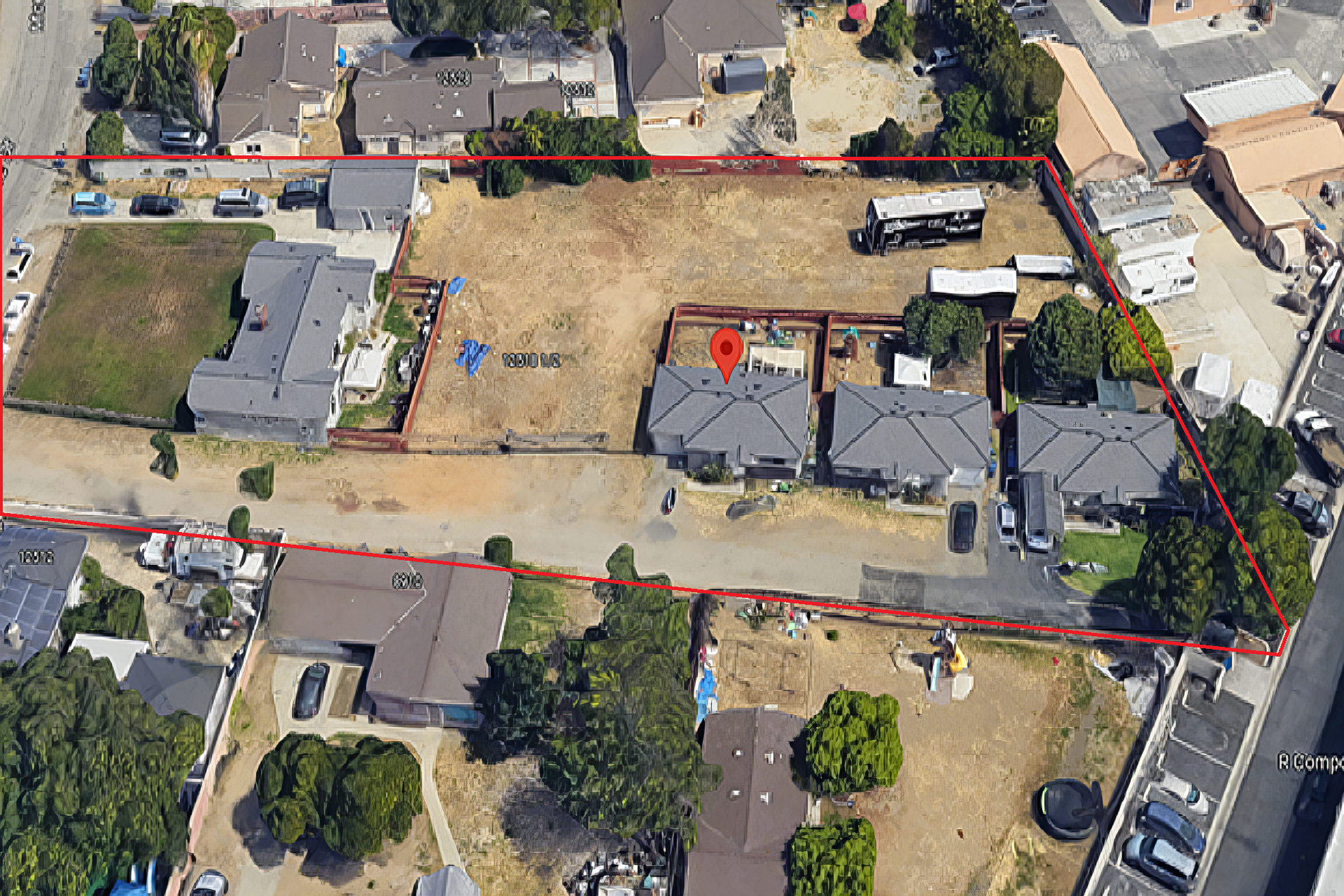

Long Beach, CA

$1,365,000

Kevin, thanks so much for finding us the perfect temporary bridge loan for this distressed property. I look forward to moving the asset into a permanent loan with you as soon as we turn it around. You have always found the best financing option for us, and the deal always closes. I look forward to many more deals together in the future. ~ Gary Ruhlen, Investor

SEE THIS PROPERTY ON "OUR RECENT FEATURED FUNDINGS" ON OUR HOME PAGE

Santa Fe Springs, CA

$1,150,000

Just Funded! Our new client was referred to us by one of our longstanding Residential Mortgage Broker’s in our Network. These well-seasoned full-time Real Estate Investors were looking for cash-out to do some minor renovations to the subject property and use the other portion of the proceeds to purchase an additional property. We went with one of our “Go To” banks, that still offers highly competitive rates and terms on their portfolio product, for quality core located Industrial properties, versus other competitors in today’s turbulent mortgage market.

We are so glad that our residential mortgage broker was able to refer us to your company! The entire TLC team was so knowledgeable and patient with us and a pleasure to work with. ~ JFM Family Partnership, Real Estate Investors

Stanton, CA

$3,050,000

Just Funded! We recently contacted our VIP client on a refinance retention campaign we ran, alerting our clients to the potential for notable future increases in their rates and payments, when their loan converts from fixed to adjustable. We previously funded the current loan 2.5 years ago. The client’s intention is to hold the property for the foreseeable future, so doing something proactively now makes a lot of sense with rising interest rates. We were able to negotiate a new loan at 3.925% with the current lender, with the same exact terms as before, but the fixed period was extended for another 5 years. With current rates in the high 6’s low 7’s, and not appearing they will be coming down anytime soon, this was a no-brainer.

Our Real Estate Agent referred us to Kevin and his all-star team, when we were purchasing a multifamily property together in La Habra, CA a few years ago. Since then, TLC has navigated the financing on multiple transactions for us. The team’s knowledge, expertise, accuracy, and diligence in the way they conduct business is unmatched. They go the extra mile, are easy to work with and make us feel like we are the most important clients they have. We look forward to many more transactions together in the future. ~ JFIG STREET, LLC, RE Investors

Buena Park, CA

$6,680,000

Just Funded! We recently funded a purchase transaction for our VIP client and evaluated his entire portfolio with him at that time. We identified loans that would have notable increases in the rates and payments when they go from fixed to adjustable. He expressed serious interest, so we marked our calendars and followed up with him when the time came. Our current analysis confirmed it was advantageous to be proactive and stop higher rates from killing his cash flow upon adjustment and in the future. If he let the rates roll, under the current terms, he would have been looking at fully indexed rates in the mid to high 8’s! Reacting quickly together, we were able to lock a rate in the mid 6’s on our in-house product, while rates were swiftly moving into the 7’s with most lenders at the time. Our VIP client could not have been happier with the financing results we delivered!

Long Beach, CA

$2,360,000

Just Funded! We recently funded a purchase transaction for our VIP client and evaluated his entire portfolio with him at that time. We identified loans that would have notable increases in the rates and payments when they go from fixed to adjustable. He expressed serious interest, so we marked our calendars and followed up with him when the time came. Our current analysis confirmed it was advantageous to be proactive and stop higher rates from killing his cash flow upon adjustment and in the future. If he let the rates roll, under the current terms, he would have been looking at fully indexed rates in the mid to high 8’s! Reacting quickly together, we were able to lock a rate in the mid 6’s on our in-house product, while rates were swiftly moving into the 7’s with most lenders at the time. Our VIP client could not have been happier with the financing results we delivered!

Sign Up For Our Newsletter

We will get back to you as soon as possible.

Please try again later.

Contact Us

TLC Financial Network, Inc.

43385 Business Park Drive, Suite 200

Temecula, CA 92590

(877) 342-TEAM (8326)

(951) 363-1984

(866) 864-7507 eFax

Mon-Fri 9:00 AM - 5:00 PM PST

info@tlcfinancialnetwork.com

Real Estate Broker - CA Department of Real Estate License Number: 01261091

By accessing this website, you agree to be bound by our Terms of Service, Privacy Policy and Investment Disclaimer

All Rights Reserved | TLC Financial Network, Inc.

All Rights Reserved | TLC Capital Partners Fund I, LLC